Profitability and Tech is always an interesting question. In analyzing the US tech giants, generally the business model, such as in the case of Google and Facebook, came as a result of getting to scale quickly, reinforcing network effects with very little focus on initial cash flow generation. Monetization would come only later as the platform has already established itself as a gateway monopoly on its users attention span. I won’t bore readers with further analysis on these tech aggregators, Ben Thompson over at Stratchery already does a fine job covering this topic.

But what about companies that had intense competition and a lack of ready venture capital? how do companies get the capital to build themselves to scale? What if they don’t have an effective monopoly on consumer attention span? What do they use to stem the cash burn? In thinking about these questions, I came about two type of cash engines that large “tech” firms and in fact others before have used to power themselves into scale in the US and China tech ecosystem. The two engines are essentially the positive working capital cycle and video games.

The WC Cash Engine

Following the playbook of every retail giant before, from Sears to Walmart: with scale, one significant advantage is that you now have enough bargaining power to pay suppliers 30 days while your customers pay you upfront, this working capital cycle than can generate the free cash flow needed for you to get to scale so long as you grow by heaps and bounds. Amazon, Alibaba and JD essentially were able to get to scale of this business model. Amazon has been self funding since the early 2000s though operating cash flow generation (of about USD10 billion/year today). The cash gets spent on reinforcing its scale through logistics build out as well as to funding new ventures such as AWS. To the same extent, this is how the ecommerce platform Alibaba and JD have also built themselves up to scale.

The Video Game Cash Engine

To study Tencent is to study video games. For most of its history, Tencent was playing second fiddle to portals such as Sohu and Sina. For close to a decade, its QQ messenger platform was largely an AIM clone with no effective monetization. Yet the company was an early pioneer in terms of microtransactions on gaming platforms. Its video game segment was highly profitable and it engaged in a decade of both acquiring and developing its own video games. The cash flows generated by this segment went towards the development of the Wechat platform when the mobile wave arrived in the 2010s.

Existing Cash Engines

In studying Amazon and Tencent, we see that both companies had different but strong cash engines. The engine had two purpose, one which was to make them into quasi venture capital funds, as they both were able to deploy capital into ancillary businesses which become billion dollar enterprises (AWS in the case of Amazon and Wechat in the case of Tencent). Another was that the cash flow provided a cushion in period of distress, such in the aftermath of the dot-com cycle for Amazon and in the case of Tencent, keep it relevant in the face of strong competition. As a result, history has shown these cash engines create both upside optionality and downside protection from a risk reward perspective.

As we are interested in outperforming investments, are there any second tier incumbents today who have similarly comparable cash flows models which created embedded upside option value and downside protection? The two that comes to mind today are JD and Netease. JD is essentially playing the same game as Amazon, it generated Q2 TTM FCF of ~USD4.5 billion, compared against ~USD10 for Amazon, the cash is recycled into building out logistics centers, automation, acquisitions (Dada, BitAuto, etc.), all with a single minded purpose of getting to massive scale. This was already a long term position of mine and Richard over at Value Ventures already has done some very high quality coverage on JD. But another cash engine often neglected in reference to Chinese TMT is Netease.

NetEase Financial Profile

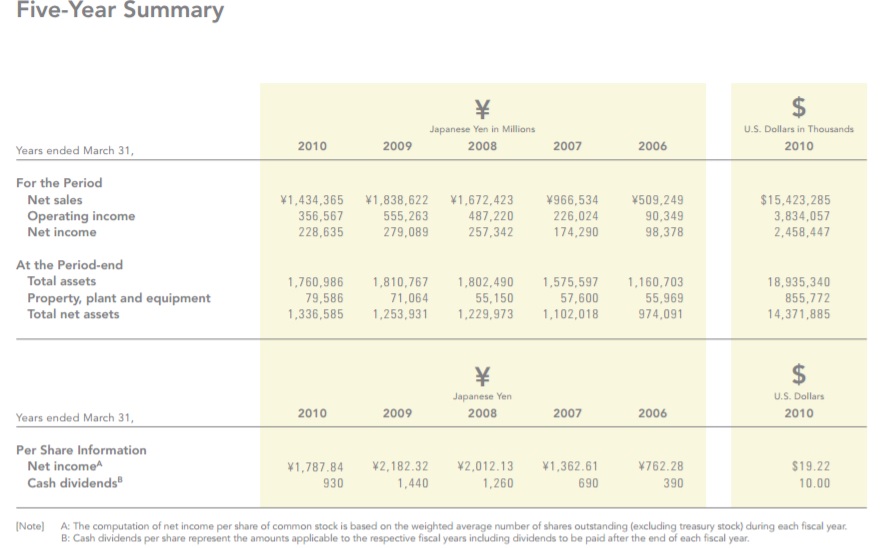

As my thesis is centered around the cash engine, it is important to go through the financial profile of NetEase. The company today has a ~USD40 billion market cap. It has ~USD6 billion of cash on the balance sheet and has consistently generated USD1-2 billion in FCF every year (more than USD2.2 in 2016 and on track for ~USD2 billion in 2017). As a result, the company is trading at a very reasonable 15x EV/FCF.

The History of Change

Typically, capital markets discount Chinese companies relative to their U.S. peers as a result of a focus on governance, VIE structuring worries, country risk and perceived notion of copycating without any real innovation. What I found as a technology watcher over the years is that there are some real positive points to Chinese companies outside of growth. One example is that Chinese management tend to be more mentally flexible and adaptive to change in a way that one simply does not see in the U.S. Outside of the notable example of Apple, there are only a handful of companies that were able to right the ship when industry/market changes have been eroding the original core business model. Netease’s history demonstrates one of one of the most successful pivots in modern corporate history.

Following a stint as an engineer for U.S. based Sybase, the then 28 year old William Ding created 163.com as a free email service based on the RMB500,000 he had earned for developing a telecommunication billing software. Initially setup in 1997 as a hotmail clone when China only had 600,000 internet users, the company quickly began to copy the yahoo model of internet portal aggregation which included a search engine, news, chat services and web hosting. By 1999, with 6.7 million internet users, the web was taking off and Netease was generating close to 4.2 million page views and had 1.7 million registered users for its e-mail services.

The Dot-Com Era(1997-2002)

By 1999, the country had just opened its technology sector to foreign capital and Netease was able to raise USD70 million and list on Nasdaq together with the two other popular portals, Sina and Sohu. However by 2001, the Nasdaq bubble had burst and the shares in Netease had fallen by over 95%, from a peak of USD3.4/share to 17 cents/share. To add to its troubles, there was discovered accounting irregularities that led to the resignation of the then CEO King Lai and COO Susan Chen. William, having briefly become a paper billionaire only to fall back into obscurity, took back control of the company and over the objection of his board, took his company into a direction that would bring it back into relevance.

The PC Era (2002-2009)

In 2001, the company developed Fantasy Westward Journey, one of the first desktop based MMORPG in China. Inspired by the 16th century Chinese novel, Journey to the West, the game became an instant hit, quickly scaling user base by more than doubling every year. By 2005, the game had 25 million registered users and was the largest and most profitable game in China at the time. Buoyed by the successful pivot into game development, Netease began to develop a host of other titles such as Tianxia III, Heroes of Tang Dynasty Zero and Ghost II. Seeing the success of the MMORPG genre in China, Netease began its partnership with Blizzard for the which it is best known for, operating World of Warcraft in China, which at its peak had 20 million users, accounting for approximately half of all World of Warcraft players globally. By 2007-2009, the company was generating USD300-500 million in net revenues and earning half of that in profits. However, it wasn’t until the Mobile era did the company really hit its strides.

The Mobile Era (2010-2017)

By 2010, the company was dominant in the Chinese PC gaming space, but the market had started to Change. Smart phones were starting to become popular and the market for mobile games had opened up. At its start, the market was fragmented, with casual games dominating the charts such as Happy Element’s Anipop and Happy Fish and Idreamsky’s distributing foreign titles such Temple Run, Subway Surfer and Fruit Ninja. Tencent had an early lead into mobile gaming, leading with titles Gunz Dash, Speed Up, Fight the Landlord and as time went on furthered its dominance with titles such as Legend of Mir, We MOBA and Happy Lord. By 2015-2016, Tencent was dominating the top 10 charts of Android and iOS games which seemed further solidified with the purchase of Supercell in 2016 for USD8.6 billion. Netease on the other hand was playing catch-up. By 2014, the company had developed mobile versions of its popular PC games, such as Fantasy Westward Journey and Ghost Story, which remain hits to this day. In 2016, the Company generated a another home-run with the Japanese Heian-era themed RPG Onmyoji. Today, the company is neck and neck with Tencent, with 4 of the top 10 mobile games by revenue in China, same as Tencent.

Gaming Going Forward

More Recently, Tencent has again taken back the top chart with its King of Glory title, a mobile version of the globally popular Dota styled game League of Legend made by Riot Games, which was acquired by Tencent in 2011. The game became a sensation overnight in China, with over 160 million monthly active players and 80 million daily active users. By May 2017, the game had become the highest grossing mobile game in the world. The game is on track to generate USD7 billion in 2017 revenues and is expected to contribute to 50% of Tencent’s 2017 mobile gaming revenue or 20% of its overall 2017 revenues. But as is always in a highly competitive and attention driven market, Netease is has made a comeback in recent months with the development of Wilderness Survival(荒野行动) or Rules of Survival, as it is known in NA, a copy of the latest global hit PlayerUnknown’s Battleground (PUBG), unseating Tencent’s dominant MOBA from the monthly #1 charts. As we can see, Netease’s capabilities as well as ability to partner with foreign partners to operate their titles has made it every bit as competitive as Tencent, despite engaging in less blockbuster style acquisition of studios.

The Art of Capturing the Consumer Surplus

As I have talked about in my previous gaming sector primer, one of the beauty of the economics of gaming is the ability to price segregate. This is the so-called freemium model in which one can acquire lots of customers cheaply early on by providing the game for free and then creating in-game purchase only items which can make one more powerful, allowing the capture of so called “Whales” who can spend indiscriminately. Everyone is quite familiar with this model when it comes to gaming, and it has been receiving strong push-backs from the consumer base recently.

It turns out that there is great art and subtlety in the balance between monetization and user experience. It is important not to too empower the higher spenders which turn-off the rest of the user base as well as making small/non-spenders still feel like they are progressing. Companies that have managed this balance well are for example the popular Japanese mobile game Puzzles and Dragons as well as League of Legend, and Counterstrike:Source Zero, where generally the monetization is largely cosmetic and there is still a large skilled component to gameplay. U.S. game developers are late to this gaming, having primarily built themselves around a movie-like model and as a result have been too hamfisted in terms of shoving monetization down people’s throat, such as EA’s Real Racing 3 and the new Battlefront II.

Chinese developers, such as Tencent and Netease, have had decades of experience now with managing large and dynamic user-bases and striking the right balance between monetization and user experience, simply because the propensity to spend was quite low in China in the early years and gaming in China is quite social, which require very good community management and a user feed-back loop. In the latest call with Netease, William stressed that monetization of Minecraft would come later, despite the massive 30 million customer base achieved in just two quarters, in order to build up the mod ecosystem and only then would the company think about monetization. I believe this is the right call, gaming companies need to think more long-term about games as building, managing ecosystems that keep its occupants happy. As such I am confident that the Chinese incumbents are thinking very systematically and quite adapted to the new realities of gaming monetization.

In fact I will even further and suggest that lessons learned by Tencent in managing the ecosystems of its games is what created the DNA that allowed it to build, manage and built on top of the world’s largest/greatest social network platform. The types of lessons learned from managing large scaled games is akin to running a small country with the ability to run economic and social experiments. Thus the types of insights gained into user psychology, utility and network structure are invaluable to the building of future consumer facing businesses. In fact, the pivot to video games for NetEase likely came as the result of an early tracking and understanding of consumer preferences and spending patterns. As such, I believe there is significant upside optionality in NetEease in various other industries/segments that are being completely discounted.

In a future article on Tencent, I will expand the idea that managing video games is much like running a country, why this may result in the creation of a 2.0 version of the East India Company and how this may create a post-political world run by technology companies. For a preview, think about the popular approval rating today of Amazon versus the current U.S. political system.

Upside Optionality in E-commerce and Food

On top of gaming, Netease also runs a fast growing foreign branded B2C platform Kaola.com. Since its launch in 2015, Kaola has become the largest cross-border e-commerce player in China, with about USD1 billion in GMV in 2016 and growing at 80-100%, on target to hit ~USD2 billion GMV in 2017. Netease is making a big push to ramp-up the Kaola platform, promising to purchase USD11 billion worth of inventory over the next three years from Japan, Europe and the US. With a market leadership position in the segment, it should not be surprising if Kaola is able to achieve USD8-10 billion in GMV by 2020, an impressive feat for a company with little e-commerce exposure just two years ago.

In addition, Netease is engaged in the pork farming business. The company created the subsidary Weiyang Farms for the raising of high end pigs in China using high quality feeds and sustainable methods. The company raised its series A from Dianping, Sinovation and JD totaling USD23.5 million. Pork is an important staple for the Chinese diet and recent auctions by the company have shown the ability to price high end pork at the same level as Kobe beef. While the premise may seem ridiculous to people, I believe the demand is there very large demand for organic, high quality pork in China and that the opportunity though still nascent, could become quite large in the coming years.

Valuations

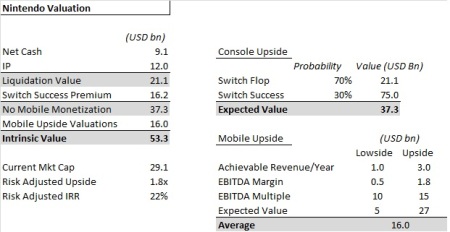

I think in the case of high cash flow businesses with little expected growth, the market typically prices the company like a utility, typically somewhere between 8-12x FCF. For Netease, the utility approach would value the business at around USD29 billion, or at a 33% discount to the current market price. In a sense, the market is not pricing in a huge amount of upside to the business. But this seems extremely conservative for a company that has been able to successfully pivot to gaming and transition to mobile over the past 20 years, delivering returns to share holders in excess of 35%, compounded for the past 20 years. This goes back to my previous write-up on Nintendo and the influence of short term cycles on pricing. Wall Street rarely ever look at the bigger picture and narrowly focuses on short term quarterly earnings and outlooks, and as such cyclical hit driven businesses such as gaming will inevitable be undervalued in periods between the big hits, even if the hits are every couple of years. This is especially relevant as Onmyoji is tapering off in China and is only just now expanding into North America.

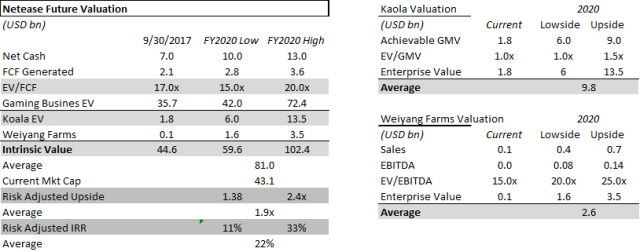

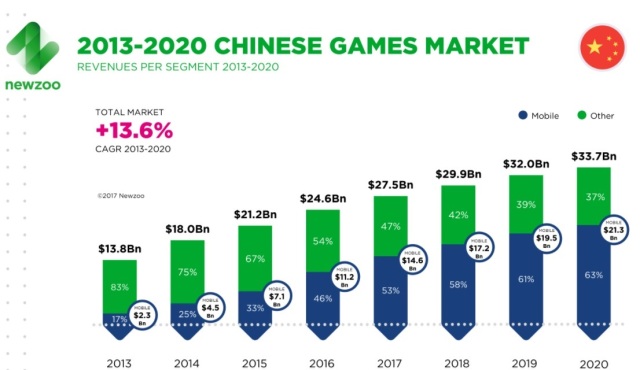

With that in mind, I want to approach it from a more long-termed perspective. On a very conservative basis, the gaming market in China is growing by 9.4% per annum, according to Newzoo. So assuming Tencent and Netease each continue to hold between 35-45% market share, the underlying gaming business of Netease should be worth USD40-70 billion by 2020. What is not being priced in is the Growth of Koala and Weiyang, which in my mind should be worth USD6-14 billion and USD1-3 billion respectively. This combined with the cash hoard of USD10-13 billion should put the value of of the business at between 60-100 billion market cap. On a risk adjusted basis, this is expected to generate a 1.9x CoC creturn and a IRR of 23% for three years, a respectable return over any index.

At the current price of around USD300-310/share, trading at around 20x TTM PE and 15x 2017 FCF, while offering a 1.3% dividend yield, I consider the stock very attractive on a risk adjusted basis.

Source: Newzoo

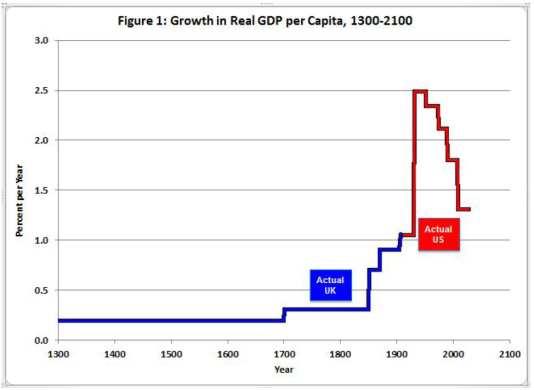

Source: Newzoo Something changed starting in the 1800s and continues today. The industrial revolution rapidly changed the way wealth and power was concentrated. For the first time in human history, wealth was not simply a product of merchandise arbitrage and a residue of power, but was driven by a marriage between innovation and capital accumulation. This process started in the 1800s and really reached its zenith in the 1900s, where GDP per capital in the western world saw a 10 fold increase. But a story often forgotten was that the western human population increased rapidly over this period as well, tripling in the 1800s and again in the 1900s.

Something changed starting in the 1800s and continues today. The industrial revolution rapidly changed the way wealth and power was concentrated. For the first time in human history, wealth was not simply a product of merchandise arbitrage and a residue of power, but was driven by a marriage between innovation and capital accumulation. This process started in the 1800s and really reached its zenith in the 1900s, where GDP per capital in the western world saw a 10 fold increase. But a story often forgotten was that the western human population increased rapidly over this period as well, tripling in the 1800s and again in the 1900s.