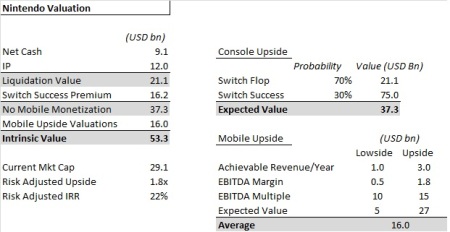

Nintendo provides an unique binary outcome opportunity which provides an attractive risk adjusted return due to the asymmetry of the payoff.

Unlike its western counterpart in Disney, Nintendo is relatively disliked by Wallstreet and investors. For the past decade or so the company has flopped on new platform releases and failed to make significant headway on mobile (with falling interests in Pokemon Go and a flop in Mario run). But there is substantial brand value and cash on the balance sheet of the company which provides a substantial margin of safety. In addition, there is upside optionality in the release of the switch platform and large potential IP capitalization opportunities in mobile which is being underestimated by current investors,

Liquidation Value

The company has over USD9 billion in net cash, no debt and a substantial IP portfolio. The company owns and controls valuable franchises in Mario, Pokemon, Zelda, Metroid, Animal Crossing, Starfox, Donkey Kong, Kirby, Pikman, etc.

The IP created by Nintendo over the past 50 years simply have unprecedented reach and are nearly impossible to replicate. Surveys have been done which show that Pikachu and Mario are more recognizable characters than mickey mouse. The huge popularity of Pokemon Go across multiple geographies in 2016 certainly support this story.

The most valuable IP owned by Nintendo is Pokemon, which is 1/3 controlled by Nintendo and 2/3 by two other companies (Gamefreak and Creature Inc). Nintendo has an undisclosed stake in Creature Inc and most analysts assume that Nintendo have a defacto control over Pokemon Inc, implying ownership at slightly greater than 50%.

In a recent License Global! report, the Pokemon company disclosed that it managed to generated USD2.1 billion in revenue last year. With marginal overheads, we can assume it generates anywhere between USD1.5-1.8 billion in free cash flow. Valued at a reasonable 10x FCF would put the pokemon company at between USD15-18 billion, or which Nintendo’s stake is somewhere around USD7-9 billion.

To estimate the IP value of the remaining Nintendo IP portfolio, we can look at some other recent IP paid:

- 2015 Activision Acquisition of Kings Digital/Candy Crush: USD5.9 billion

- 2012 Disney Acquisition of Lucasfilm/Star Wars: USD4 billion

- 2009 Disney Acquisiton of Marvel: USD4 billion

It is very reasonable for the remainder of the Nintendo IP to be worth atleast USD4 billion, with Mario and Link being the most valued IP of the pool. If we then estimate the total IP of Nintendo to be in the USD11-13 billion range. The company should have a liquidation value (Cash + IP) of around USD21 billion.

At Nintendo’s current valuation of around USD29 billion, investors value the company at around a 38% premium to the company’s liquidation value. Given that any acquisition will require a significant premium over the cash + IP value, it stands to reason that USD21 billion represents a bottom estimate for a floor of value for the company.

Cyclical Business

It should be noted that Nintendo stock pricing is highly correlated to the sales of its popular consoles.

To some extent, the company is similar to Pixar prior to the Disney Acquisition.

As Michael Burry corrected surmised in 2000, Wallstreet has a poor record of valuing hits driven businesses like Pixar, where shares tanked between the releases of Toy Story 2 in 1999 and Monster Inc in 2001. The intermediate gap in which revenue is low while production/operation costs remained steady creates volatility in earnings which caused short term investors to exit on mass despite healthy underlying fundamentals.

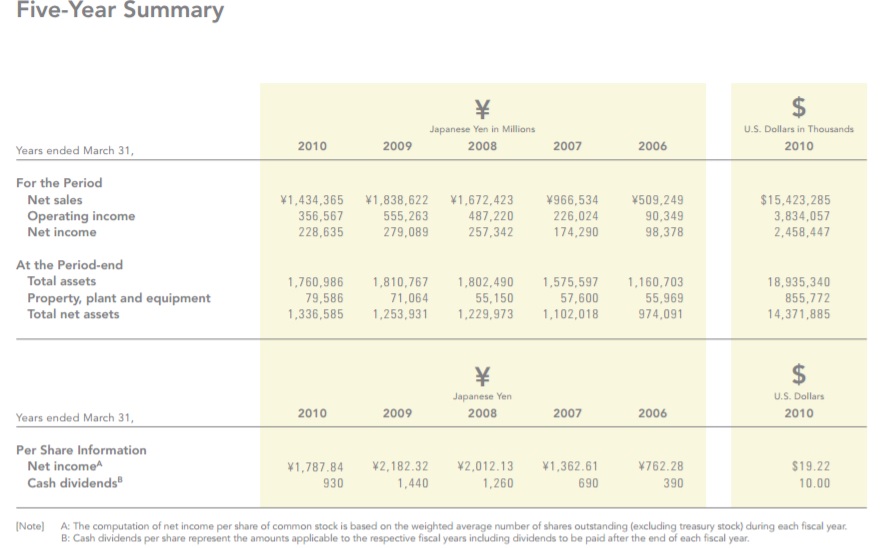

At its peak in 2007-2009, Nintendo’s revenue more than tripled and EBIT increased five fold from sales of the Wii console.

From 2010 – 2016, with sales from the Wii falling off, and a largely unsuccessful Wii U launch, revenues have hovered in a steady state of USD5-6 billion. Share prices hit their lows in 2013-2014, when a historically stable (2000-2010) EBITDA margin of 23-30% went into negative territory from the write-down of inventories of Wii-U and higher than normal R&D expenses as Nintendo ramped up preparation for the NX console. By 2015-2016, EBITDA margin increased to 8-12%, which is still far below historic levels as a result of falling sales from a lack of major game launches.

Upside Potential

It is quite difficult to forecast any financial/cashflow measures off a hits driven business, when margins and FCF could differ significantly dependent on levels of sales, which is why it may be helpful to think in simple heuristics. If the new console, the Switch, will replicate the success of the Wii, it is possible for the share price to hit USD70-80 billion market cap space. This is discounting any upside value of further monetization of the mobile space.

At a downside of USD21 billion in liquidation value and a upside of USD75 billion, the current market cap of USD29 billion reflect the market pricing a 15% chance that the Switch will be a hit, assuming also no further mobile potential. I believe this is an incredibly conservative assumption. While it is true that in recent years, the game market has bifercated between hardcore console gamers who demand the latest technology (xbox and ps) and casual gamers who have migrated to the smartphone/pad platform, the Wii proved that there is a market for casual party games in the console format, especially if it is user friendly. The success of the 3DS platform shows there remains a large market for dedicated handheld gaming devices. If we assign a simple one third chance that the Switch will become a hit, the shares are trading currently at a 22% discount.

Another thing to note is how differently Nintendo is positioning itself relative to Sony and Microsoft in its marketing strategy. There is no focus on having the best graphics and specs. If you look at the commercials for the Switch, there were no kids anywhere to be found, just 20-30 year olds. This gaming machine is marketed as a nostalgia machine for Millennials, which isn’t being fully appreciated. How many of us wish we could go back to carefree elementary school days of playing your n64 after school, or to the highschool/college days of playing the Wii with your buddies for hours on end. Now you are toughing it out in the real world, loaded with student debt, struggling to save for a down payment amidst soaring home prices, dealing with marriages/relationships, potentially having first kids. Gosh, don’t you wish you could just go back to the days when you could play Mario Cart with your buddies all over again. Boomers had their cars and I suspect Nintendo is probably the equivalent for millennials. In addition, the relatively poor sales numbers for Xbox one (26 million units) and even Playstation 4 (47 million units), relative to previous generations is a sign there may be a large opening here.

Even if Console becomes a dead end for Nintendo, mobile remains a huge underdeveloped potential source of revenue for the company. Of the top 10 best selling games of all times across all platforms, 5 were games developed by Nintendo. If Nintendo were to shift its focus to mobile gaming apps, there is a high probability that it could dominate the mobile gaming market, given its widespread IP recognition. If a underdeveloped version of Pokemon managed to rank #4 in the top grossing app in the U.S., generating USD2.1 billion in revenues, it is easy to see any number of Nintendo IPs generating similar sales figures. If Candy Crush could be valued at USD6 billion for generating USD2 billion in annual revenues, it is easy to see 1-2 Nintendo games consistently in the top 10 charts, generating USD5-16 billion of valuation uplift.

Conclusion

The recent move by Nintendo in terms of releasing Mario Run has convinced me that management have changed their perception towards exclusivity of the gaming IP. I have no doubt Nintendo will stumble initially moving into the mobile market but there is a very good chance that with its IP it can generate significant hit games over the next 2-3 years. Given the strong smart phone penetration (more than 2 bn globally compared against 100 mn for the 3ds), it is a much higher margin business with potentially more reach.

As a result, On a risk adjusted basis, assuming a 30% chance of a success of its next Gen console and eventual success at smartphone/tablet monetization, Nintendo looks relatively attractive.

On a upside basis, should the Switch prove to be very successful, together with mobile monetization, the shares could trade at 3-4x current valuations over the next 2-3 years, generating IRRs in excess of 100%. I believe that at current prices, Mr. Market is pricing in very little upside to a company with 125 years of operating history, a strong portfolio of gaming IPs and a track record for creating both successful consoles and titles. This looks to be an attractive investment opportunity.