“What is it that you believe in that almost nobody else believes in?” – Peter Thiel

I think one of the most important thing that nobody really believes in is that we are entering a protracted period of low growth, driven by demographics, slowing technological change and a miss-attribution of productivity. Despite the early preview that we have seen from Japan, the belief in stagnation has very little following among academic economists, although the idea is percolating through the mainsteam through the likes of Tyler Cowen and Larry Summers.

The Lie That Benefits Everyone

A world of increasing growth is one that almost everyone benefits. Companies can comfortably keep their current business plans. Investors can continue to enjoy an increase in earnings which justify ever higher asset values. Consumers and workers benefit from increasing incomes, improving goods and services. The public sector can continue to take on ever large debts, which is erodes in real terms over time by growth and large pension liabilities can easily be managed (see Investors above).

The Evidence for Growth

“During my lifetime, here’s a guy that was born in 1930 … my lifetime real GDP per capita went up six for one. Well, to think of an economy that already was among the top in the world, having in one person’s lifetime a six-for-one change in real output per capita, that’s staggering. That’s never happened in the history of the world.” – Warren Buffett

It is true that the U.S. economy has grown remarkably since the 1930s, and most economic models assume a forward rate of real growth of 2+% going forward. However this was not always a straight forward paths. During the great depression, there were talks of prolonged economic stagnation due to falling birthrates and very high savings, but growth bounced back strongly in most countries following the end of WWII. For someone who was born in the 1890s and lived to the 1970s, the world would’ve changed far beyond what he could have imagined. From a transportation perspective, we went from horses to cars, from being grounded to widespread air travel and the moon landing. In the home, we went from wood stoves to widespread electrification and the rise in television and radio. Large businesses and corporations were adapting mainframe computers to improve organizational management and solving complex problems. This is essentially the power of compounding and a exponential function. If one was to extrapolate from the amount of progress that had been made from the 40 year period from 1930s to the 1970s, one would logically assume that we would all be vacationing on mars and have solved aging over the next 40. Which turned out to be far too optimistic.

The Evidence for Stagnation

“We wanted flying cars, instead we got 140 characters.” – Peter Thiel

The GDP per capita of the U.S. in 1950 was around $9,500 on a inflation adjusted real dollar basis, by 1980, this had increased to around $18,600, an approximate two fold increase, representing a real growth rate of about 1.4%. However, from 1980 to 2010, the GDP per capita grew to $30,500, representing a 1.6x increase, or a 1% growth rate, at a notable decrease from the first 40 years.

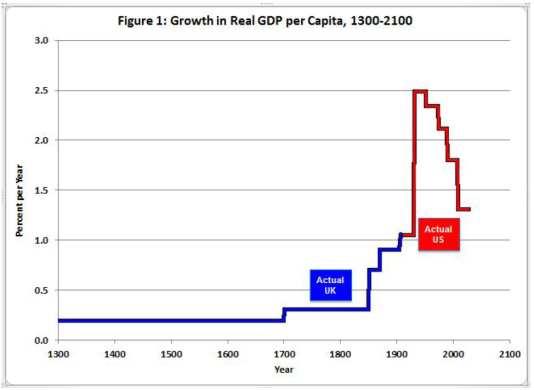

From a historical perspective, even a 1% growth rate is a large increase in improvement. For most of human history, growth was non-existent, economic power was largely a function of population growth, which was sustained by agricultural improvements. Power was held by kings and wealth and status was largely concentrated in the form of land granted to favored individuals.

Something changed starting in the 1800s and continues today. The industrial revolution rapidly changed the way wealth and power was concentrated. For the first time in human history, wealth was not simply a product of merchandise arbitrage and a residue of power, but was driven by a marriage between innovation and capital accumulation. This process started in the 1800s and really reached its zenith in the 1900s, where GDP per capital in the western world saw a 10 fold increase. But a story often forgotten was that the western human population increased rapidly over this period as well, tripling in the 1800s and again in the 1900s.

Something changed starting in the 1800s and continues today. The industrial revolution rapidly changed the way wealth and power was concentrated. For the first time in human history, wealth was not simply a product of merchandise arbitrage and a residue of power, but was driven by a marriage between innovation and capital accumulation. This process started in the 1800s and really reached its zenith in the 1900s, where GDP per capital in the western world saw a 10 fold increase. But a story often forgotten was that the western human population increased rapidly over this period as well, tripling in the 1800s and again in the 1900s.

Demographic Slowdown

One of the easiest things to predict in economics is demographics. The number of 20 year olds in 2037 is set in stone, baring immigration, one just has to look at the number of births today. in the 1950s, the US population was 150 million, which roughly doubled going into 2000. Think about going forward 50 years, it is highly unlikely that the growth rate is likely going forward. Native birth rates are at below replacement levels and immigration is the primary source of population increases. Given the rise in protectionism and populism, it seems unlikely that immigration will continue at the same pace. According to the IMF, By 2050, we will end up with a population of between 350 – 400 million. If one thinks about GDP as a component of productivity and population growth, population growth was driving somewhere around .80-1.2% of real GDP growth. From 1900 – 1950, population growth averaged around 1.4% per year. From 1950-2000, it averaged around 1.2%. By the 2000s, population growth averaged only around 0.75%. If we extrapolate things forward, it is very possible that we may see growth rates of only 0.5% for the next 20 years.

Productivity

I suspect that we have significantly overestimated individual productivity. A major labor trend since the 1930s has been the rising participation of women in the labor force. In a single breadwinner family, a women’s labor such as home child rearing and homemaking was not part of GDP numbers. As more and more women entered into the workforce and had to hire nannies/babysitters and order more takeouts, these numbers started flowing into GDP, creating what is essentially overstated growth. I suspect somewhere around 30-50% of the per capita growth probably came from this shift. If one looks at trend among high income household, there is actually a strong preference for wives to spend their full time raising children instead of pursing careers. So if this overstatement was driving a large part of individual productivity numbers, it is highly likely that the adjusted real GDP per capita was increasing only at somewhere between 0.5-0.7% over the past 40 years.

Additionally, there are signs that even this low productivity number is falling. If one thinks about it in terms of technology and innovation, it is increasingly concentrated around Silicon Valley. We have far more scientists and engineers than we ever had in the 50s and 60s, but if we measure things in terms of new inventions, the productivity levels are now at abysmal levels. There are fewer companies being formed today than anytime over the past 40 years. In large parts of the U.S. there is a hollowing out of industry, a decline in real income and a sense of desperation that fed into a Trump victory.

But it wasn’t always like this. In the 1950s, there were dozens of Silicon Valleys. Southern California was seeing a renaissance in aerospace technologies. Chicago was the home to many great electronic manufacturers employing millions and Detroit was the center of automotive technology, employing millions of engineers, designers and workers. Over time, the number of hubs of innovation have shrunk, and by the early 2000s, we are left with the twin hubs of Finance (NY) and Information Technology (Silicon Valley). After the GFC, it may be that we are left with only Silicon Valley.

Growth Going Forward

If one adds the declining population growth of 0.5% and a GDP per capita increase of only 0.5-0.7%, we end up with a real growth rate of somewhere around 1.0-1.2%, a remarkable decrease from prior decades of over 2.0%. This number is corroborated by Robert Gordon in his TED talk. The implications are huge, this level of growth no longer implied a 50% increase in living standard every 20 year (or a generation). The debt crisis we see in the developed world today is a direct consequence of this lack of growth.

Return to Feudalism

It is very possible that the industrial revolution was a one time event in human history and that we will revert back to a sort of semi-stagnant world. Or it may be that we will have a prolonged period of stagnation (similar to the dark ages) before reaching another industrial revolution like event.

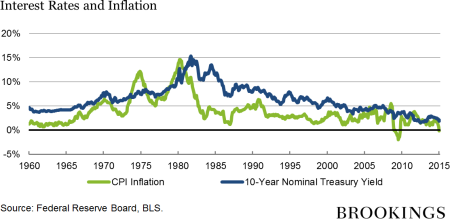

Either way, the short term implications are dire. It is highly unlikely that we can expect significantly higher company earnings going forward (as companies are already telling us through buying back shares instead of investing), it is unlikely we will see sustained rise in REAL interest rates. More importantly, it is unlikely that we will see the significant improvements to living standards that have historically made this country the optimistic beacon of hope to the world.

What does a neo-feudal America look like? While the concept may seem strange to a lot of people, actually I would like to suggest that it unsurprisingly looks similar to now. High and rising asset values, increasingly expensive and elitist education as young people compete for fewer high earning jobs, increasing wealth inequality and a out of touch upper-middle class. But we have seen this before, in fact, this was the norm for much of human history.

In ancient feudal societies, power came from the king/emperor, and nobles received wealth, power and titles from the king. The major assets were property based or monetary (gold/silver) and wealth largely came from inheritance from previous generations and either earned through trades or gained through grants by the king. For your average commoner however, land ownership was forever out of reach relative to the price of labor. It wasn’t until the industrial revolution that all of this changed. Labor started becoming more important relative to property and inheritance. The likes of Carnegie and Ford came from relatively austere background but were able to grow large fortunes through their intellect and entrepreneurship. We saw this at its very extreme in the 1950s, where a high school educated worker could get a factory job and comfortably own a house, two cars and have a stay-at-home wife. But now we are going back to the era where family fortunes are becoming more important. Asset prices continue to rise relative to income, making owners of capital wealthier at the cost of new potential owners. The dynamic is similar to the feudalism of old, except now productive assets include a mix of financial assets instead of just land. One can see this in its rawest form in places like China today, where residents in Beijing and Shanghai acquired 3-4 housing unit through their work units for cheap (effectively getting noble status from the emperor) in the 90s and make far more on rent and price appreciation today than ever working. The education system today has become a simple proxy for wealth for the privileged and a cruel indentured servitude for the multitude. The only channel left in terms of social mobility seems to be studying Computer Science (see above on Silicon Valley) at a high tier state university these days which can secure a relatively high paying job without going into unimaginable debt.

Living in Stagnation Land

While most commentators focus on policy maker levers, inevitable debt defaults or inflation that may come about as a result of the unwound in high leverage built up in pursuit of growth which won’t come, my belief is that central bankers can probably suppress the volatility in such a way where the debt simply gets nationalized over time (see Japan which now owns over half of its national debt). Either way, it is incredibly naive to presume that anyone has any optics on how it will play out. Regardless of what policy options are selected, I don’t believe the underlying malaise is solvable, as a result the investment angle is relatively straight forward.

The compression in nominal interest rates that has lit the fire on asset prices starting in the 80s and drove much of asset price appreciation will still be ongoing. After all, in a 1% growth world, why should risk-free rates be anything but zero on a real basis? Why should inflation be anything but hovering slightly around zero. In such a world, wouldn’t a 4% corporate bond yield and a 8% equity return still be a bargain? What would happen if inflation fall to zero? Wouldn’t a 2.5% 10 year gov bond be quite attractive? What would happen to equities that are yielding 10% if people demand it only 5%, couldn’t equities still double?

In this stagnant world, you are probably not getting paid enough to take on new risks and there is very little compression left on the fixed income side. Chances are you would be quite happy getting a 3% dividend and marginal earnings yield from Proctor and Gamble and so will the millions of boomers who will have to de-risk their portfolio in the coming years.

Essentially there are two ends of the investment spectrum that offer the most opportunities: Monopolistic businesses which can generate decent ROE and are nearly impossible to disrupt and large technology conglomerates that are eroding traditional business models through information technology as it is the only disruptive sector left.

This then leads one to conclude that an optimal U.S. based portfolio involves holding a large amount of something like Berkshire Hathaway and a few technology disruptors like Amazon. Additionally, as the market forward prices in more of this bimodal distribution, there will be opportunities to grab discounted companies which people perceive as strongly threatened by incremental innovation but are actually fairly robust to it.